Accounting

Major, Minor and Certificate

Earn a bachelor’s degree in accounting and prepare for Iowa's CPA exam at a pace designed for working adults.

Providing adult undergraduate students the finest accounting education possible, focusing on convenience and affordability.

If you have earned some college credits and are looking to complete, or if you've never taken a college course but have decided to pursue your degree, Simpson can help you reach your goals. Earn a Bachelor of Arts in one of seven, high-demand degree areas in an online learning environment.

Accounting

Computer Information Systems

Criminal Justice

Human Services

Management

Management Information Systems

Marketing Communication

Open the door to the business world

Our broad based, liberal arts curriculum is designed with the general needs of employers in mind. By studying business management, law, economics and statistics in addition to your accounting coursework, you'll have the foundational knowledge to you need to succeed in your new career: accounting expertise and skills in critical thinking, analysis and communication.

You’ll complete 128 credits to graduate from Simpson with a bachelor's degree in Accounting. If you want to also qualify to take the Iowa Accountancy Examining Board CPA exam, you’ll take an additional 22 credits, for 150 credits total.

ECON 100: Principles of Economics

This course utilizes the analytical approaches and tools of economics to examine current issues and problems that occur in economic systems. Particular focus is paid to the examination of macroeconomic and microeconomic markets, how they determine what is produced, and the role government plays in the allocation of resources. 4 credits

ECON 135: Applied Statistics

Fundamentals of descriptive and inferential statistics studied through business applications. Topics include central tendency and variability, frequency distributions, elementary probability theory, binomial, normal, and t-distributions, sampling theory, confidence intervals, hypothesis testing, regression analysis.Prerequisite: One of MATH-105/105T, MATH-130/130T, Math ACT of 22 or higher or Math SAT of 530 or higher. Students majoring in a Social Science should take SOC/PSYC-210 rather than this course. Credit will not be given for both SOC-210 or PSYC 215 and ECON-135. (QUANT) 4 credits

- Acct 201 Introduction to Accounting

- Acct 250 Introduction to Accounting Systems (Pre-req Acct 201)

- Acct 341 Intermediate Accounting I (Pre-req Act 201, Acct 250)

- Acct 342 Intermediate Accounting II (Pre-req Acct 341)

- Elective: Choose one 300-level Accounting Course*

*All prerequisites must be taken to achieve the minor designation. This may result in more than 18 hours of course credits fulfill the minor.

This path is part of Simpson College's convenient and flexible online program, which enables you to complete four to eight credits every eight weeks.

Prepare for the CPA exam

Our undergraduate program in Accounting is renowned for producing efficient and competent professionals in the field. As an adult learner in the program, you can expect the same individualized attention from faculty and academic and career advisors as you would in a more traditional setting.

You’ll work one-on-one with an advisor who will help you—from registration to graduation—to stay on track and make sure you’re taking the correct courses. You'll also have access to guest speakers, professional conferences, individual resume review and other professional development opportunities as you plan your future on your own schedule.

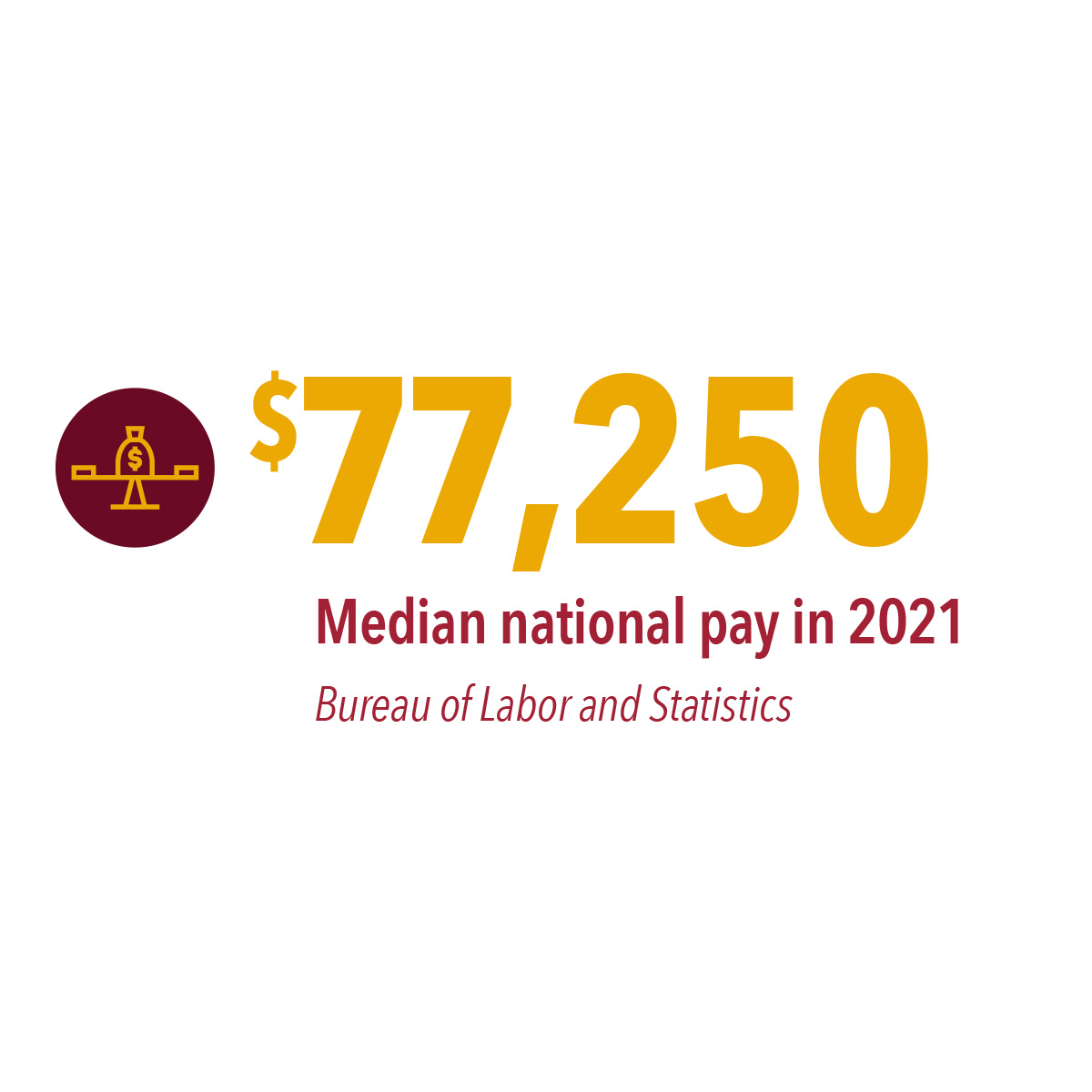

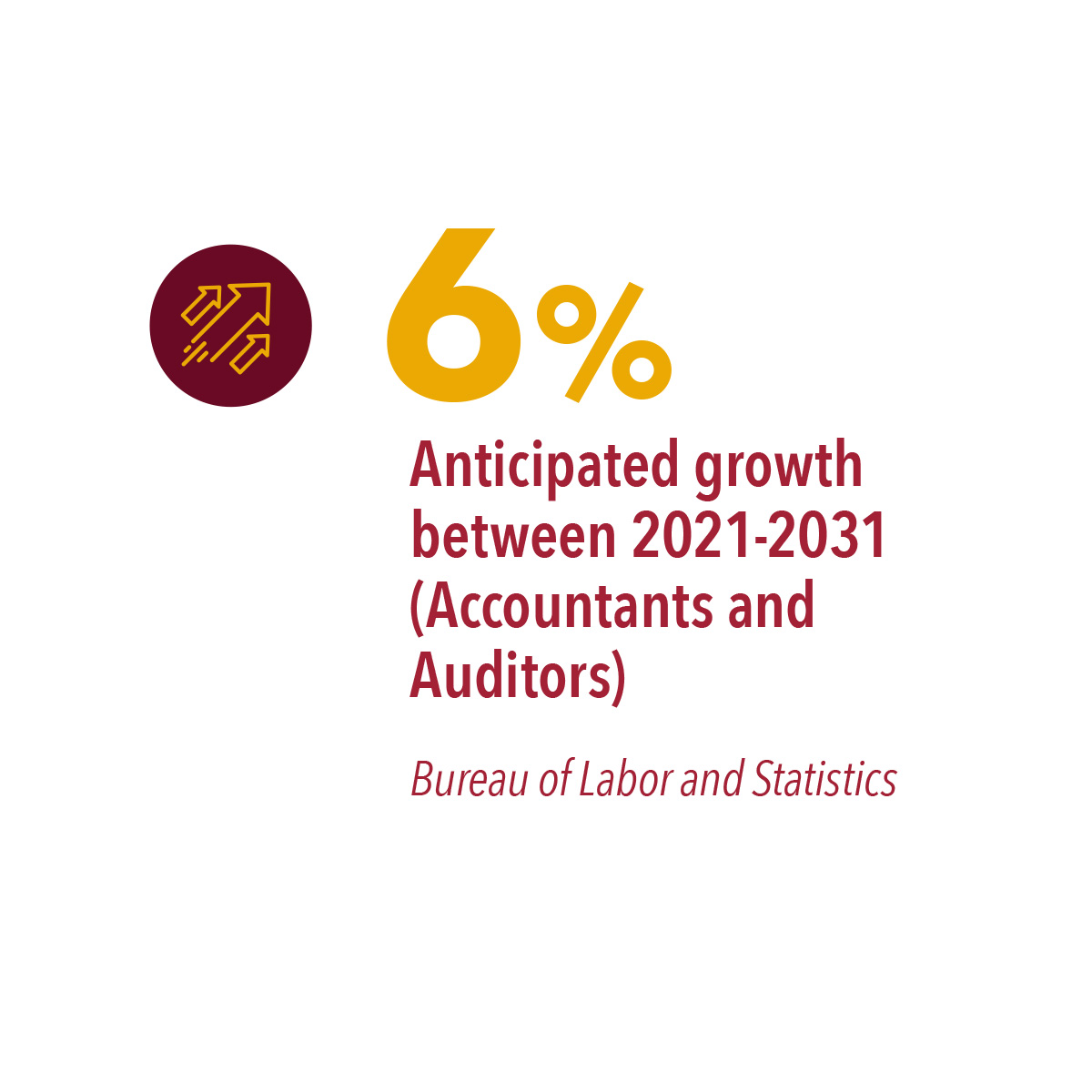

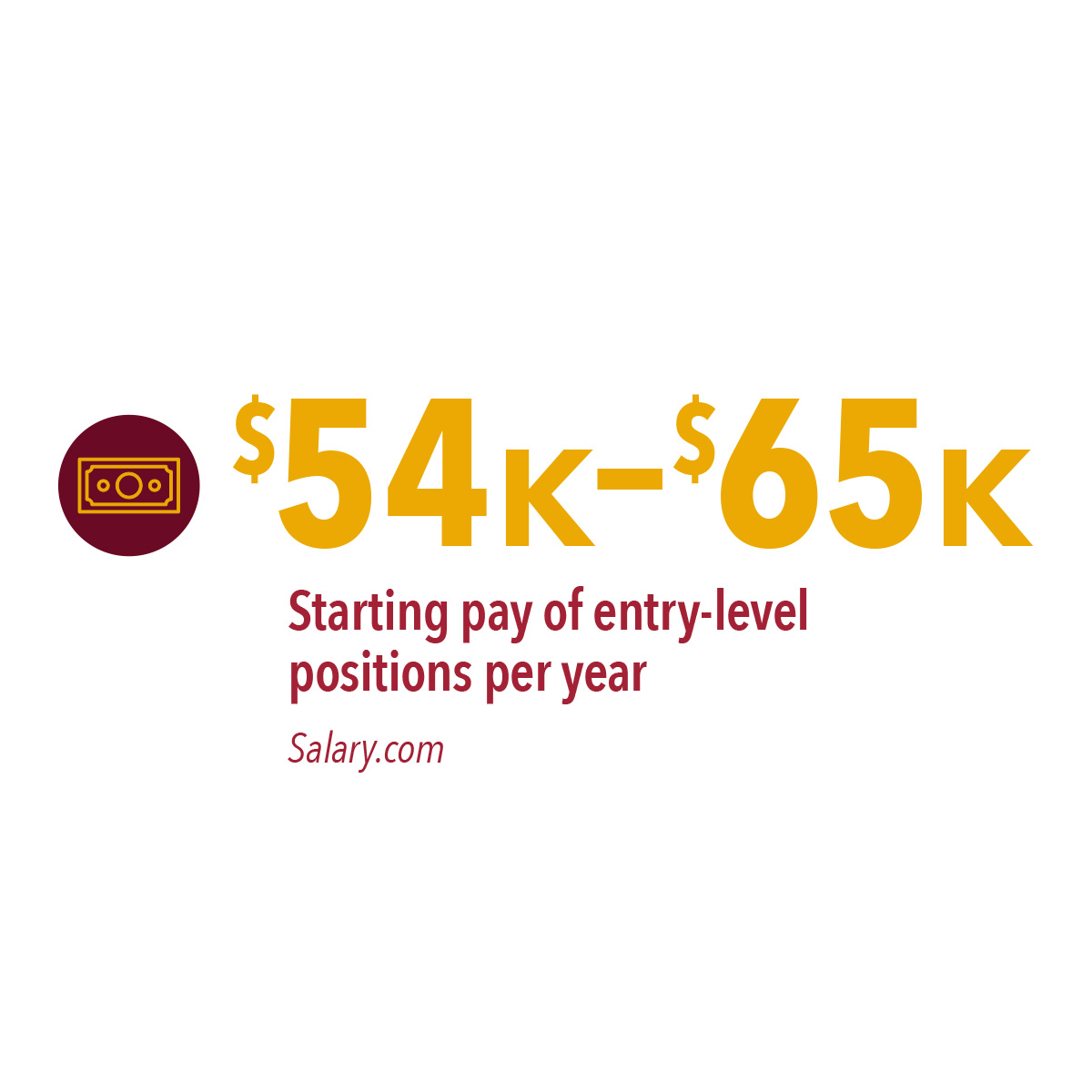

A wealth of diverse career opportunities

As an accounting professional, you'll find a wealth of diverse career opportunities. Here are professional positions some of our alumni hold.

- Public Accounting: Tax Staff, Staff Auditor, Consultant Staff

- Private Accounting: Internal/External Auditor, Financial Accountant, Cost Accountant

- Governmental Accounting: Internal Revenue Agent (IRS), Tax Specialist (IRS), Staff Accountant (SEC)

- Consulting/Small Business: Business Accountant, Financial Accountant, Forensic Accountant

Find Your Success

Tuition Costs

We're committed to making sure our adult undergraduate programs are accessible and affordable for all students.

Financial Aid

Students in this program are eligible for federal financial aid, and we allow an interest-free grace period for students receiving employer reimbursement.

Transfer Credits

We accept transfer credits from other accredited institutions. Transcripts are evaluated to determine how many credits will transfer, as well as how a student’s former coursework meets Simpson’s degree requirements.

Take Advantage of Every Opportunity

Save on Tuition

We value the work you've already done and think it should count toward your degree. If you’re at least 25 years of age and classified as a freshman or sophomore at Simpson, you can submit a Life Experience Portfolio during the admissions process. The LEP can earn up to 24 credits, which you can use to meet the 150-hour requirement for CPA exam eligibility.

Employer Reimbursement Cuts Interest Costs

Many employers reimburse their employees’ tuition after a class has been completed, and we offer the chance to delay payment until 45 days after the term ends. You won’t have to pay until after the course ends.

We're Transfer Friendly

During the application process, you'll submit transcripts of previous undergraduate work from other accredited institutions if applicable. Transcripts are then evaluated to determine how many credits will transfer, as well as how your former coursework meets Simpson’s degree requirements.